In the midst of the distribution process for special payments in the United States, many consumers are still unsure where their stimulus cheque is or when they will receive it. This uncertainty has prompted the Internal Revenue Service (IRS) to strengthen its digital channels, allowing millions of taxpayers to follow their payments from home and without the necessity for face-to-face interactions.

Although hundreds of millions of dollars in checks have already been issued, a percentage of the populace has yet to get their money. This could be for a variety of reasons, including problems in the postal address, a lack of bank information, or simply because the payment has not yet been processed. That’s why having an official means to track it has become critical.

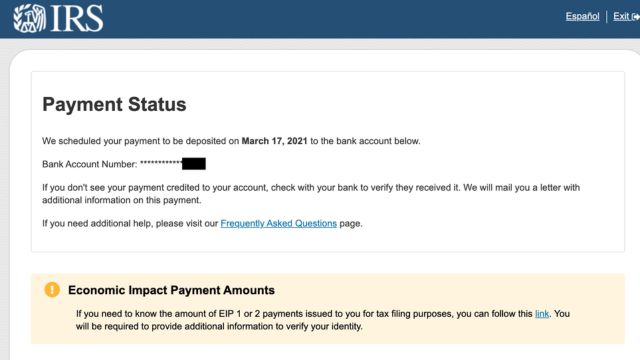

In this context, the IRS has established a specific tool that allows any qualified person to monitor the status of their payment. The digital project is called “Get My Payment,” and it allows users to not only find out where their deposit is, but also identify any issues that are preventing the money from arriving appropriately.

A tool for quick IRS stimulus check responses

Get My Payment allows taxpayers to securely access the IRS system and determine whether their cheque has actually been paid, is still processing, or if there was a delivery issue. To begin the query, they must submit some basic personal information, such as their Social Security number, date of birth, postal address from their previous tax return, and, if feasible, a copy of their most recent tax return.

Once the form is completed, the system generates one of three messages. If the payment has been sent, the date it was processed will be shown. In contrast, if the IRS has not yet scheduled the deposit, a warning will display indicating that the date is currently unavailable. Finally, if the notice requests additional information, it signifies that the cheque was returned to the IRS because the post office failed to deliver it appropriately.

In the latter instance, it is best to act quickly: update the postal address, double-check the bank details, or even contact the agency personally to resolve any errors that are preventing the money from being sent.

Payments are still ongoing in 2025

So far, the IRS has given more than 127 million payments, totaling more than $325 billion. These deposits are done via a variety of methods, including direct deposit, real checks, and prepaid debit cards. However, checks are still pending, thus the government has affirmed that mailings would continue into the first half of 2025.

Furthermore, if all payments have not been processed by June, the IRS will extend the deadline for three months, extending it to September 2025. This allows taxpayers a reasonable amount of time to claim what they are owed.

Different stimulus checks, different amounts

Although many people believe that everyone receives the same amount, the truth is that stimulus checks differ from case to case. The IRS can send up to $1,400 per individual, $2,800 for married couples filing jointly, and an extra $1,400 for each dependent shown on the tax return.

As a result, it is best to be aware of your current tax situation, ensure that all dependents are properly included, and, if possible, set up direct deposit so that the money arrives faster and with less margin for error.

With all this in mind, if you still don’t know where your stimulus check is, the best alternative is to use Get My Payment as soon as possible. This tool is essential for clearing up any doubts, correcting errors, and ensuring that the IRS gets your payment to you as soon possible.